Building a home is one of the most exciting and significant investments you can make. But with so many moving parts — from finances to market trends to personal timing — the question often arises: Is now a good time to build a home? This question isn’t just about market timing; it’s about balancing your financial readiness, lifestyle needs, and the current housing environment.

Understanding the Current Housing Market

Before you pick up that blueprint, understanding the housing market is critical. It sets the stage for your building journey and can significantly affect costs, timelines, and even the future value of your home.

Home Prices and Lot Availability

The first thing to look at is home prices and the availability of land lots in your desired area. When home prices soar, building might be more expensive, but it could also mean your finished home will have a higher resale value. Conversely, if prices are falling or stable, it could be a more affordable moment to build — but watch out for market declines that could impact your investment.

Land availability also matters. In some areas, good lots are scarce and expensive. Research local zoning rules and check with real estate agents or local planning offices (you might find this helpful on your own site, homeimprovementcast.co.uk) to gauge how easy it is to find a suitable plot.

Construction Material Costs and the Labor Market

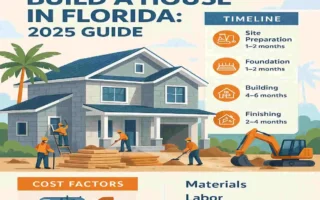

Next, keep an eye on the cost of construction materials like lumber, steel, concrete, and fixtures. Prices fluctuate based on global supply chains and demand. For example, shortages or tariffs can cause spikes that inflate your budget unexpectedly.

Labor availability is equally important. A shortage of skilled builders, electricians, or plumbers can delay your project and increase costs. Check local construction reports or builder associations to get a sense of current labor market conditions.

Real Estate Market Trends and Forecasts

Finally, look at the broader real estate market trends. Are home sales increasing? Are mortgage rates rising or falling? What’s the forecast for your region? Trusted resources like government housing reports, property market forecasts, and mortgage rate websites can provide data to help you anticipate whether the market will favor buyers or sellers.

Tip: Subscribe to newsletters or use online tools that track “home building market trends” for real-time updates.

Financial Considerations When Building a Home

Money talks — and when it comes to building a home, it talks a lot. Making sure you’re financially ready is one of the most crucial steps.

Budgeting Essentials and Financial Readiness

Start with a detailed budget that includes:

- Land purchase price

- Building permits and fees

- Construction costs (materials, labor)

- Design and architectural fees

- Landscaping and outdoor work

- Contingency fund for unexpected expenses (usually 10-15%)

Having a clear budget helps you avoid surprises and makes financing more manageable.

Impact of Interest Rates and Mortgage Availability

Interest rates directly affect your mortgage payments. When rates are low, borrowing money to build a home is more affordable. But if rates are rising, your monthly payments may increase significantly, impacting your budget.

Right now, mortgage trends show [insert latest data linking to authoritative mortgage rate source], so it’s wise to consult with mortgage specialists to understand how current rates affect your borrowing power.

Financing Options: Construction Loans vs Traditional Mortgages

Building a home typically involves specialized financing:

- Construction Loans: Short-term loans that cover building costs. They often have higher interest rates and convert to traditional mortgages once construction is complete.

- Traditional Mortgages: Used if you buy an already built home, but may also apply if you refinance after construction.

- Builder Financing Programs: Some builders offer financing options, which might come with perks but require careful review.

Personal and Lifestyle Factors

Even with perfect market conditions and finances, your personal situation matters as much.

Timing Based on Family and Work

Are you planning to grow your family? Is your job stable, or might you relocate soon? Building a home is a long-term project, often taking months or more than a year. Consider if your personal circumstances allow for this commitment.

Readiness for the Building Process

Building a home requires patience and involvement. You’ll need to make decisions, handle stress, and manage timelines. If you’re ready to dedicate time and energy, the process can be rewarding. If not, waiting might be wise.

You may also read (managing people processes and progress in construction workflows).

Future-Proofing Your Home Needs

Think about your lifestyle goals. Do you want a home office for remote work? Energy-efficient features to save costs long term? These needs influence your timing and design choices.

Benefits and Risks of Building Now

Every decision has pros and cons. Let’s break down what you gain and what you risk by building now.

Benefits

- Customization: Tailor every detail to your taste and needs.

- Modern Amenities: Incorporate the latest tech and energy-saving features.

- Potential Cost Savings: If you catch a dip in materials or labor costs.

- Equity Growth: A new home in an appreciating market can build wealth.

Risks

- Economic Uncertainty: Market shifts can affect costs and home value.

- Delays: Permits, inspections, and supply chain issues can push back timelines.

- Cost Overruns: Unexpected expenses can strain budgets.

- Changing Regulations: New building codes might increase costs or require redesigns.

Real-Life Examples

- Case 1: A family built during a market upswing, saw strong home appreciation, and enjoyed a stress-free process thanks to good planning.

- Case 2: Another owner started during a supply chain crisis, faced delays and cost overruns, but ultimately ended up with a dream home after adapting.

Summary of Pros and Cons

Benefits Risks

Full customization , Potential cost overruns

Latest amenities , Delays in construction

Energy-efficient options : Market value fluctuations

Building equity : Regulatory changes

Practical Steps to Determine if Now Is a Good Time

Ready for action? Here’s a simple guide to help you decide.

- Research Local Market and Economy: Use online tools, talk to local agents, and check forecasts.

- Assess Financial Health: Review your budget, savings, and get pre-approved for loans.

- Consult Professionals: Speak with builders, architects, and financial advisors.

- Analyze Personal Readiness: Evaluate your time, stress tolerance, and family plans.

- Understand Timelines: Know typical build times and potential delays.

Setting Your Timeline

Align your build schedule with both economic cycles (like interest rate trends) and your personal calendar.

Call to Action: Consider a feasibility study or pre-construction consultation to ensure your plans are realistic and well-informed.

Additional Tips and Considerations

Location and Future Development

Check local development plans, school zones, and infrastructure projects. These can affect your home’s value and livability.

Environmental and Regulatory Factors

Be aware of zoning laws, environmental restrictions, and building permits. These impact when and how you can build.

Technological Advances

Smart homes and sustainable building materials are growing trends. Incorporating these features can improve your home’s comfort and enhance its resale value.

Current Trends Impact

Remote work has changed home design priorities, making home offices a must-have for many. Green building is gaining momentum, affecting both design and timing.

Stay Updated

Markets and regulations change. Make it a habit to keep informed about your local area and funding options.

You may also read (how to choose the right contractor for your home renovation).