Imagine you’re a first-time homebuyer, excitedly scanning listings, eyeing your dream house. The price tag looks great, but when you start adding up all the extra costs—down payments, fees, taxes—you realize the total is far beyond your initial budget. This surprise can be overwhelming. So, how much does it cost to buy a house in 2025?

In 2025, buyers should expect to pay between $410,800 $512,800 for the home itself, depending on location and market conditions. But the story doesn’t end there. Thousands more in fees and hidden costs can quickly add up. Knowing what to expect beforehand helps you budget smart, avoid surprises, and make confident decisions.

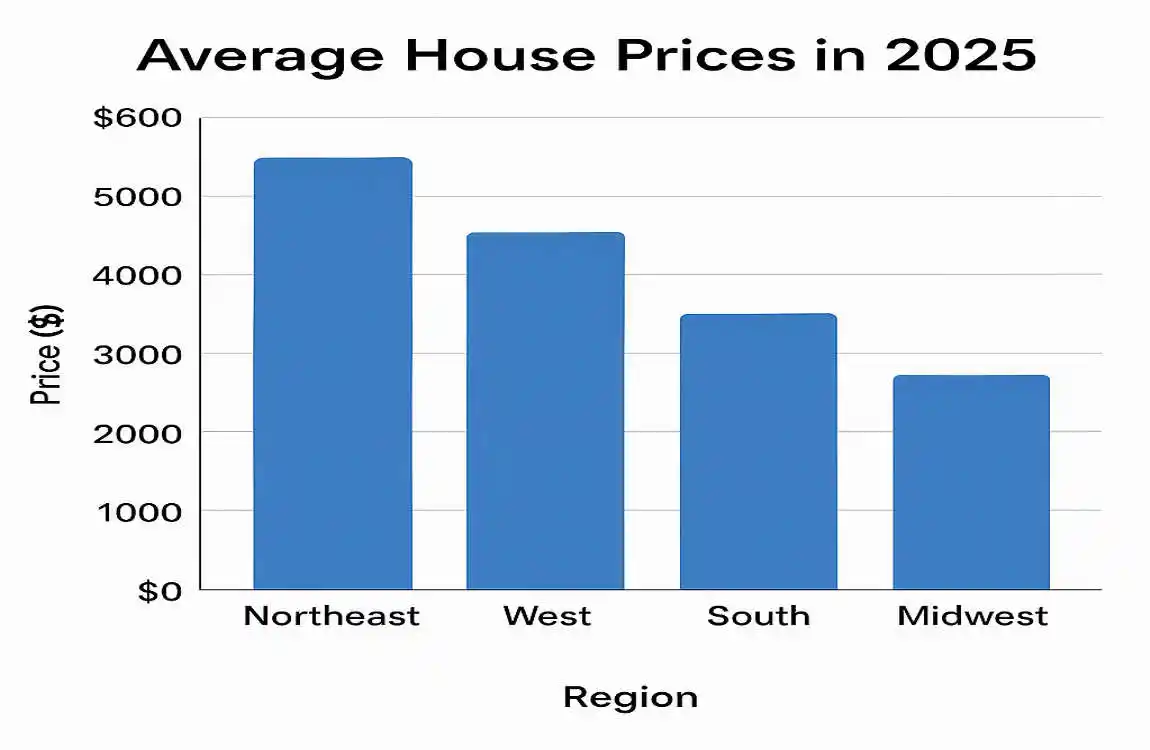

Average House Prices in 2025

National Averages

The big question: what does a house cost right now? According to the latest data, the median sales price in the U.S. is around $410,800 in mid-2025. The average price is even higher, at about $512,800. That’s a notable increase—up roughly 38% since 2020.

This rise shows the housing market is still strong, though growth is starting to slow as interest rates hover around 6-7%. Higher borrowing costs cool demand slightly, but low inventory keeps prices elevated.

State-by-State Breakdown

Prices vary widely depending on where you look. Here’s a quick snapshot of median prices in some key states:

State/Region Median Price (2025)Average Price (2025)

US National $410,800 $512,800

Hawaii $977,538 N/A

California ~$800,000+ N/A

Texas ~$350,000 ~$400,000

Florida ~$370,000 ~$420,000

Midwest Avg Under $300,000 Under $350,000

As you can see, places like Hawaii and California are far pricier than more affordable states in the Midwest or South. This highlights the importance of location when budgeting for a home.

Historical Trends

Looking back, home prices have surged dramatically over the decades. Since 1980, prices have jumped about 544% nationally. This long-term growth reflects factors like inflation, population shifts, and economic expansion.

Forecasts for 2025 suggest slower but steady price gains, especially given ongoing interest rate hikes aimed at curbing inflation. Buyers should expect prices to rise modestly, but they will still face stiff competition for available homes.

Factors Driving Prices

Several key forces shape home prices today:

- Inventory Shortages: There aren’t enough homes for sale, pushing demand higher.

- Interest Rates: With mortgage rates near 6-7%, borrowing costs influence how much buyers can afford.

- Location: Urban areas and coastal states command Premium prices, while rural and less populated areas remain more affordable.

Down Payment & Mortgage Basics

Down Payment Range

Once you know the home’s price, the next big step is the down payment. This is the upfront cash you pay toward the purchase price of your home.

- Typical down payments range from 3% to 20%.

- On a $512,800 home, that means between $15,384 (3%) and $102,560 (20%).

- FHA loans, popular among first-time buyers, require as little as 3.5% down, making homeownership more accessible.

Mortgage Types & Rates

Your mortgage is the loan you take to cover the remaining cost of the home.

- Fixed-rate mortgages offer a consistent interest rate and monthly payment.

- Adjustable-rate mortgages (ARMs) start with lower rates but can fluctuate later.

In 2025, rates for a 30-year fixed mortgage hover around 6.5%, meaning higher monthly payments than in recent years.

Affordability Rule

Experts recommend spending no more than 28% of your gross monthly income on housing costs. This includes:

- Principal

- Interest

- Taxes

- Insurance

This total is often called PITI.

Payment Examples

Here’s a quick look at monthly payments for a $512,800 home with a 20% down payment at 6.5% interest:

- Loan Amount: $410,240

- Estimated Monthly Payment (PITI): ~$3,200

If you put down less, your monthly payments will be higher.

Tips for Financing Success

- Build strong credit scores early to qualify for better rates.

- Save aggressively to increase your down payment and reduce the loan size.

- Use online calculators to estimate monthly payments based on different down payment and rate scenarios.

Hidden Fees & Closing Costs

Closing Costs Overview

Buying a home isn’t just about the listing price. Closing costs add another 2-6% of the home price. For a $512,800 house, expect additional fees of $10,000 to $30,000.

These costs are shared between buyer and seller, but buyers typically cover most of them.

Common Fees Breakdown

Here’s a quick table showing typical closing fees:

Fee Type Average Cost (% of Price)Notes

Loan Origination 0.5-1% Lender processing fees

Appraisal/Inspection $300-500 Verifies home value

Title Insurance 0.5-1% Protects ownership

Escrow/Recording $500-1,000 Legal paperwork filing

Prepaids (Taxes/Ins.) Varies Reserves for the first year

Overlooked Extras

Many buyers forget about these costs:

- HOA fees: Monthly charges for community upkeep, sometimes $200+ per month.

- Junk fees: Extra charges from lenders or agents that can add up.

- Moving costs: Often $2,000 or more, depending on distance and belongings.

- Immediate repairs and utilities: New homeowners should budget for unexpected fixes and setting up services.

Tax Deductions

Some costs, like mortgage interest and property taxes, can lower your tax bill. Consult a tax professional to maximize these savings.

First-Time Buyer Guide & Savings Tips

Step-by-Step Process

Navigating your first home purchase becomes easier with a plan:

- Get pre-approved for a mortgage to understand your budget.

- Budget for PITI plus maintenance costs (expect 1-4% of home value yearly).

- Shop multiple lenders to find the best interest rates and fees.

Buyer Assistance Programs

Look into:

- FHA loans with low down payments.

- VA loans for veterans offering zero down.

- First-time buyer grants and incentives available in 2025.

Cost-Cutting Strategies

- Negotiate fees and commissions. Don’t accept sticker prices without asking.

- Shop around for insurance—home insurance averages $1,500+ annually but varies widely.

- Avoid costly upgrades before purchase; focus on necessities.

- Use mortgage points to lower your interest rate if you plan to stay long-term.

Post-Purchase Costs

Owning a home means ongoing expenses:

- Property taxes typically range from 1 to 2% of home value each year.

- Home insurance protects against damage and liability.

- Maintenance and repairs average about $5,000 per year.

Handy Checklist Idea

Create and keep a homebuying checklist with these key steps and cost considerations. It helps keep you organized and financially prepared.