Modular homes are gaining popularity in today’s housing market. They offer a perfect blend of affordability, efficiency, and quality, making them a viable option for homeowners looking to build their dream home. As the demand for modular homes grows, so do the questions surrounding their design and construction possibilities. One of the most fraequently asked questions is: “Can a modular home have a basement?”

If you’re considering a modular home, auanderstanding your foundation options is crucial. Basements, in particular, offer a range of benefits, including additional living space, storage, and even an increase in home value. However, there are certain factors to consider when incorporating a basement into modular home construction.

What Is a Modular Home?

Definition of Modular Homes

A modular home is a type of prefabricated house that is built in sections, or modules, in a factory setting. These modules are then transported to the construction site and assembled on a pre-prepared foundation. Unlike traditional homes, which are built entirely on-site, modular homes combine the efficiency of off-site construction with the customization and durability of a conventional house.

How Are Modular Homes Constructed?

The construction process for modular homes involves building each module in a controlled environment. This allows for better quality control and reduces the time required for on-site work. Once the modules are complete, they are carefully transported to the site, where they are assembled like giant building blocks. This process ensures faster completion times without compromising on quality.

Modular Homes vs. Manufactured and Traditional Homes

It’s important to distinguish modular homes from manufactured homes and traditional homes:

- Manufactured homes are built entirely off-site and placed on a permanent chassis, making them mobile. They are often considered less permanent and are subject to different building codes.

- Traditional homes are built entirely on-site, which can result in longer construction times and higher costs.

- Modular homes, on the other hand, are built to the same building codes as traditional homes and offer the same structural integrity, with added benefits such as speed and cost efficiency.

Benefits of Modular Homes

Modular homes are increasingly popular for good reasons:

- Customization: Homeowners can choose from a variety of layouts and finishes.

- Faster Construction: Factory-built modules speed up the building process.

- Cost-Effective: Reduced labor costs and efficient materials usage lower overall expenses.

- Environmentally Friendly: Minimal waste is produced during off-site construction.

Understanding Basements in Residential Construction

What Is a Basement?

A basement is an underground or partially underground level of a house. It serves as the foundation of the home while providing additional space for various uses. Basements are typically constructed using concrete, which offers durability and structural support.

Common Types of Basements

Here are the most common types of basements:

- Full Basement: A fully underground level with enough headroom to be used as a living space or storage.

- Partial Basement: A smaller basement that only covers a portion of the home’s foundation.

- Walk-Out Basement: A basement with an exterior door that opens to ground level, offering natural light and easy access.

- Crawl Space: A shallow space beneath the home, often used for utilities and storage but not tall enough to stand in.

Benefits of Having a Basement

Basements offer several advantages to homeowners:

- Extra Space: They can be used for storage, recreation, or additional living areas.

- Insulation: Basements help regulate indoor temperatures by providing insulation for the home.

- Increased Home Value: Homes with basements often fetch higher resale prices.

- Flexibility: From home offices to gyms, basements can be customized for a wide range of purposes.

Can a Modular Home Have a Basement? The Basics

The Short Answer: Yes!

Yes, a modular home can absolutely have a basement. In fact, modular homes are highly versatile and can be designed to accommodate a variety of foundation options, including basements.

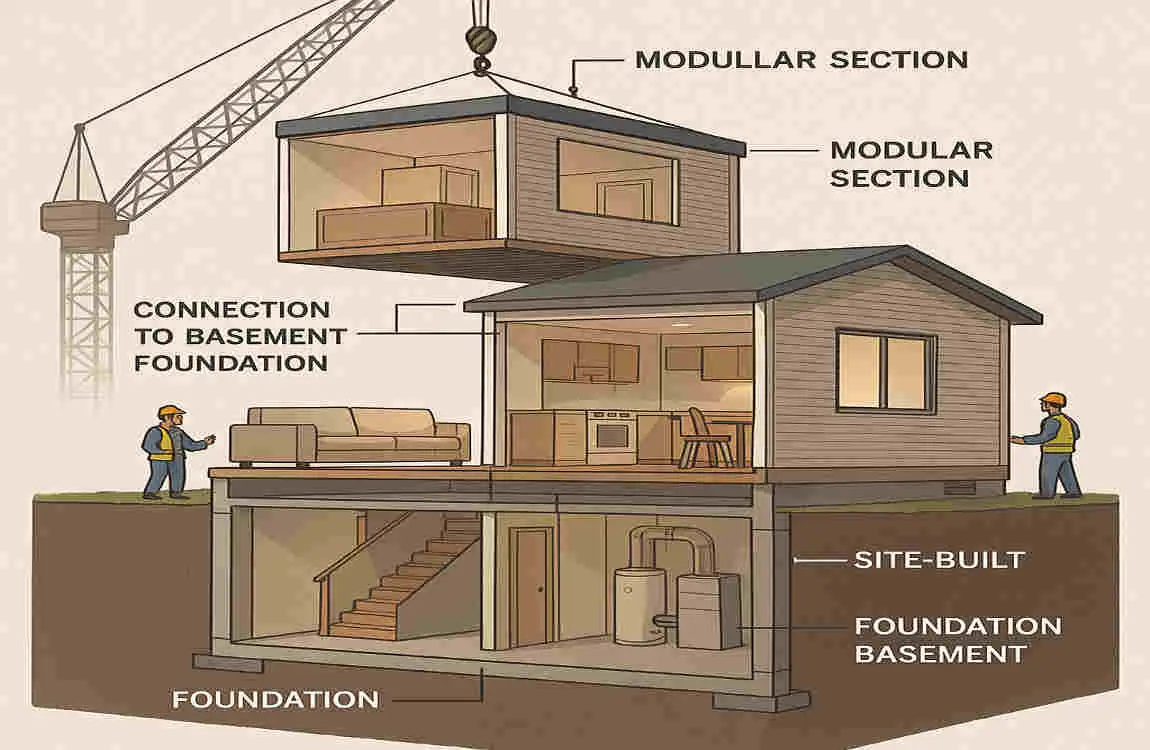

How Are Basements Incorporated with Modular Homes?

Building a basement for a modular home follows a straightforward process:

- The basement is constructed first, just like it would be for a traditional home.

- Once the basement foundation is complete, the modular home is delivered and assembled on top of it.

- The basement is then connected to the home, creating a seamless structure.

Modular Homes vs. Traditional Homes: Basement Construction

The process of adding a basement to a modular home is very similar to that of a traditional house. The key difference lies in the timeline for building. Since modular homes are constructed off-site, the foundation including the basement must be ready before the modules are delivered.

Factors Affecting Basement Feasibility

Not every site is suitable for a basement. Here are some factors to consider:

- Local Zoning Laws: Some areas have restrictions on basement construction.

- Soil Conditions: Rocky or unstable soil can complicate the excavation process.

- Climate: In areas prone to flooding, basements may require extra waterproofing.

- Budget: Adding a basement increases construction costs; therefore, it’s essential to plan accordingly.

Common Misconceptions About Modular Homes and Basements

One common misconception is that modular homes are less durable or customizable than traditional homes. This is far from the truth! Modular homes are built to the same standards as site-built homes and can include features such as basements, attics, and more.

Types of Foundation Options for Modular Homes

Modular homes can be built on various foundation types, each with its own advantages and drawbacks. Let’s explore the most common options.

Basement Foundations

- Full Basement: Provides the most usable space and can be finished as a living area.

- Walk-Out Basement: Ideal for sloped lots, offering natural light and easy access.

Advantages:

- Extra living or storage space

- Higher resale value

- Enhanced insulation

Drawbacks:

- Higher construction costs

- Requires careful waterproofing

Crawl Space Foundations

A crawl space is a shallow foundation that elevates the home slightly above ground level.

Advantages:

- Affordable and easy to construct

- Allows access to utilities

Drawbacks:

- Limited storage

- Minimal insulation compared to basements

Slab-on-Grade Foundations

A slab-on-grade foundation is a flat concrete slab poured directly on the ground.

Advantages:

- Cost-effective

- Low maintenance

Drawbacks:

- No additional storage or living space

- Not suitable for sloped lots

Foundation Type Benefits Drawbacks

Full Basement, Extra space, added value, Higher cost, waterproofing needed

Walk-Out Basement, Natural light, outdoor access, requires a sloped lot

Crawl Space: Affordable, utility access, Limited space, minimal insulation

Slab-on-Grade Cost-effective, low maintenance No storage, unsuitable for slopes

Steps to Build a Basement with a Modular Home

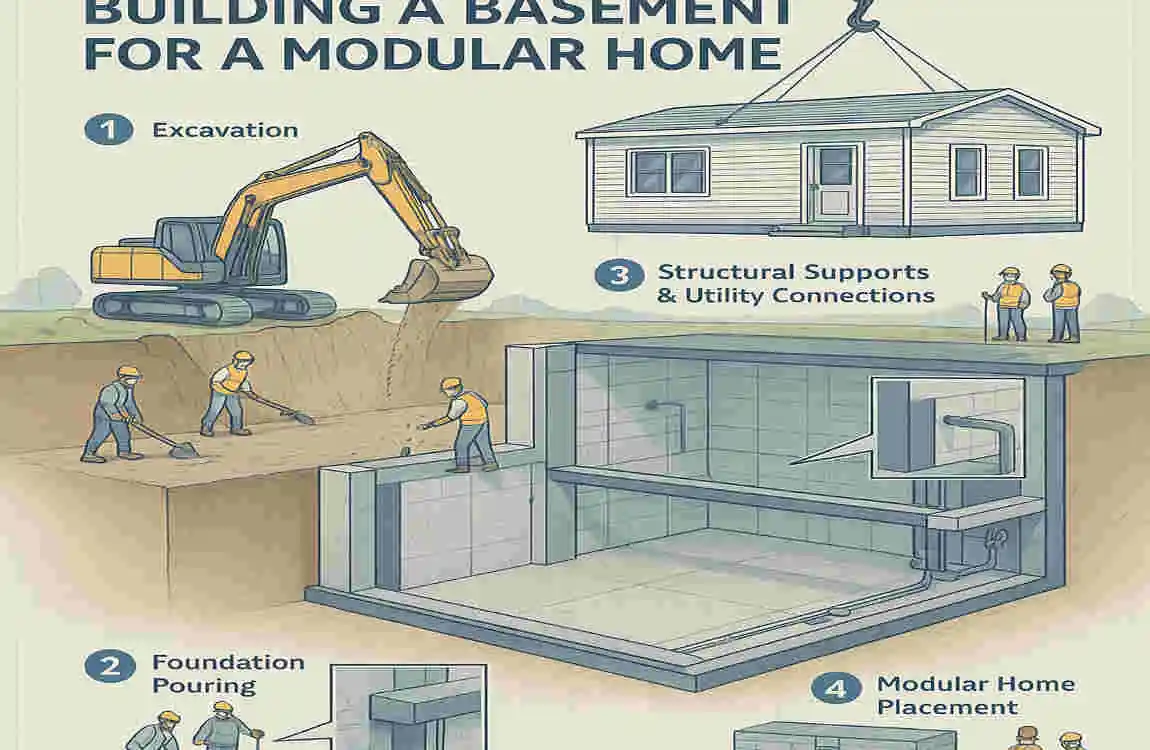

Site Evaluation and Soil Testing

Before construction begins, the site must be evaluated for soil stability and drainage. This ensures the ground can support a basement.

Hiring Contractors

Specialized contractors are needed to excavate the basement and lay the foundation. Ensure they have experience working with modular homes.

Coordinating Basement Construction and Modular Delivery

Timing is crucial. The basement must be ready before the modular home is delivered.

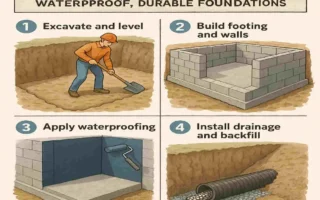

Waterproofing and Insulation

Proper waterproofing is crucial in preventing leaks and damage. Insulating the basement also improves energy efficiency.

Finishing the Basement

Once the home is complete, the basement can be finished with flooring, walls, and lighting to make it a livable space.

Cost Implications of Adding a Basement to a Modular Home

Adding a basement to a modular home project increases the cost, but it can be a worthwhile investment.

Cost Breakdown

- Excavation and Foundation: $20,000–$50,000

- Waterproofing and Insulation: $5,000–$10,000

- Finishing: $10,000–$30,000 (optional)

Comparison with Traditional Homes

Basement costs for modular homes are often lower due to the efficiency of modular construction.

Challenges and Considerations When Adding a Basement

Site Preparation

Excavating for a house basement can be challenging on rocky or sloped sites.

Regulatory Requirements

Permits are required for basement construction, and local codes must be followed.

Timeframe Coordination

The basement must be completed before the modular home is delivered.

Design Ideas and Uses for Basements in Modular Homes

Popular Layouts

- Open-concept family rooms

- Home gyms or offices

- Rental units for extra income

Tips for Maximizing Space

- Use light colors for walls

- Add large windows or a walk-out design for natural light

Real-Life Examples and Success Stories

Many homeowners have successfully added basements to their modular homes, creating beautiful and functional spaces. For example, one family in Colorado built a walk-out basement that doubled as a guest suite and entertainment area, thereby increasing the value and usability of their home.