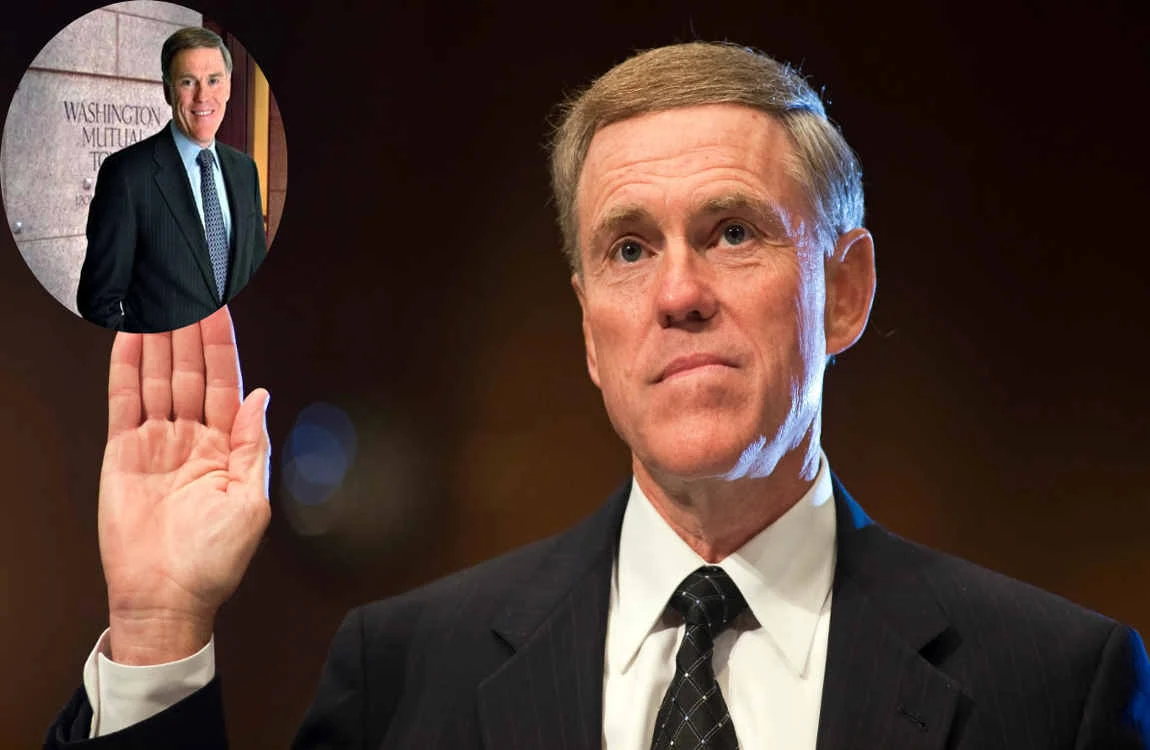

Have you ever wondered about the financial standing of one of America’s most controversial banking executives? Kerry Killinger, the former real estate CEO of Washington Mutual, has remained a figure of intrigue in the business world. His journey from building one of the nation’s largest savings banks to its dramatic collapse during the 2008 financial crisis makes his current financial status all the more fascinating.

| Category | Information |

|---|---|

| Full Name | Kerry Kent Killinger |

| Birth Date | June 6, 1949 |

| Birth Place | Des Moines, Iowa |

| Education | BBA (1970) and MBA (1971) from the University of Iowa |

| Career Highlights | Former CEO and Chairman of Washington Mutual (1990-2008); Founder & CEO of Crescent Capital Associates |

| Family | Was married to Debbie for 31 years; currently married to Linda |

| Net Worth | Approximately $53.5 million |

| Current Residence | Seattle, Washington, and Palm Desert, California |

| Philanthropy | Supports social justice, criminal justice reform, education, community building |

Who Is Kerry Killinger?

Early Life and Background

Kerry Killinger’s story begins in the heartland of America. Born in 1949 in Des Moines, Iowa, he grew up in a middle-class family that valued hard work and education. A strong academic performance and a natural inclination toward leadership roles marked his early years.

During his college years at the University of Iowa, Killinger demonstrated an exceptional aptitude for business and finance. He earned his Bachelor’s degree in Business Administration, laying the groundwork for a remarkable career in banking. His professors often noted his ability to see the bigger picture while maintaining attention to detail.

After completing his undergraduate studies, Killinger pursued an MBA from the University of Iowa’s Tippie College of Business. This advanced education equipped him with the strategic thinking skills that would later define his leadership style. His thesis focused on consumer banking trends, foreshadowing his future role in transforming the retail banking industry.

Career Highlights and Major Achievements

Killinger’s professional journey began in the 1970s when he joined Banc One Corporation. His innovative approach to consumer banking quickly caught the attention of senior management. He pioneered several customer-friendly initiatives that increased branch profitability and customer satisfaction.

In 1982, he made a pivotal career move by joining Pepper Hamilton as a financial consultant. This experience broadened his perspective on banking regulations and corporate governance. His work there involved advising banks on expansion strategies and regulatory compliance.

The turning point in his career came in 1988 when he joined Washington Mutual as president. At the time, WaMu was a regional savings and loan institution with modest ambitions. Killinger saw immense potential in the company and developed a vision to transform it into a national powerhouse.

Notable Role as CEO of Washington Mutual

In 1990, Killinger was promoted to CEO of Washington Mutual, marking the beginning of an 18-year tenure that would reshape American retail banking. Under his leadership, WaMu grew from a regional player with $7 billion in assets to the nation’s most significant savings and loan institution with over $300 billion in assets.

His aggressive expansion strategy included numerous acquisitions. Notable purchases included Great Western Financial Corporation for $6.8 billion in 1997 and Dime Bancorp for $5.2 billion in 2001. These acquisitions expanded WaMu’s footprint across the United States, positioning it as a major competitor to traditional banks.

Killinger introduced the concept of “retail banking stores” that resembled retail shops more than traditional bank branches. These locations featured open floor plans, friendly “concierges” instead of tellers, and a focus on customer experience. This innovation influenced how many banks design their branches today.

Business Philosophy and Leadership Style

Killinger’s leadership philosophy centered on democratizing banking services. He believed that everyone, regardless of income level, deserved access to quality financial services. This vision led to WaMu’s famous tagline: “The bank for everyday people.”

His management style was characterized by bold decision-making and a willingness to challenge industry conventions. He encouraged innovation at all levels of the organization and rewarded employees who thought outside the box. This created a corporate culture that was both dynamic and sometimes controversial.

However, his aggressive growth strategy and focus on subprime lending ultimately contributed to WaMu’s downfall during the 2008 financial crisis. The bank’s collapse in September 2008 marked the most significant bank failure in U.S. history, a sobering end to Killinger’s tenure.

Kerry Killinger’s Current Net Worth

Estimated Net Worth: Approximately $53.5 Million

As of late 2024, Kerry Killinger’s net worth is estimated at approximately $53.5 million. This figure represents a substantial fortune, although it’s notably less than the peak wealth he accumulated during his tenure at Washington Mutual’s helm. Understanding how he maintained this wealth despite WaMu’s collapse provides valuable lessons about financial resilience.

You may also read (jenni riveras long beach house).

The estimation of his current net worth is based on various sources, including public financial disclosures, investment records, and industry analysis. While exact figures can be challenging to verify due to the private nature of personal wealth, economic experts have pieced together a comprehensive picture of his assets.

It’s essential to note that net worth calculations encompass various assets, including real estate, stock holdings, bonds, and other investments, minus any outstanding liabilities. For someone of Killinger’s stature, these calculations become complex due to the diverse nature of his investment portfolio.

Sources of His Wealth, Including Key Investments and Stock Holdings

Killinger’s wealth stems from multiple sources, demonstrating the importance of diversification in building a lasting fortune. His primary sources of wealth include:

Stock Holdings and Investments:

- Significant positions in Washington Mutual Inc. (before its collapse)

- Notable investments in Safeco Corp, which provided steady returns

- Diversified portfolio including blue-chip stocks and bonds

- Private equity investments in various sectors

During his tenure at WaMu, Killinger accumulated substantial stock options and restricted stock units. While the bank’s collapse eliminated much of this wealth, he had wisely diversified his holdings over the years. His investment in Safeco Corp, a property and casualty insurance company, proved remarkably prescient.

Compensation and Benefits: Throughout his career, Killinger earned significant compensation packages. At his peak as WaMu’s CEO, his annual compensation exceeded $14 million, including salary, bonuses, and stock options. Even after accounting for losses during the financial crisis, the accumulated wealth from nearly two decades of high compensation formed a substantial financial foundation.

Impact of Washington Mutual and Other Companies on His Financial Status

The Washington Mutual chapter of Killinger’s financial story is both triumphant and cautionary. During the bank’s growth years, his net worth soared as WaMu’s stock price climbed. At its peak in 2003, WaMu stock traded above $45 per share, making Killinger’s holdings worth hundreds of millions of dollars.

However, the 2008 financial crisis devastated these holdings. WaMu’s stock became virtually worthless when the FDIC seized the bank and sold its assets to JPMorgan Chase for $1.9 billion. This represented a massive destruction of shareholder value and significantly impacted Killinger’s net worth.

Despite this setback, Killinger’s other investments helped cushion the blow. His Safeco Corp holdings, for instance, benefited when Liberty Mutual acquired the company in 2008 for $6.2 billion. This diversification strategy prevented a complete financial catastrophe.

Comparison of Net Worth Growth Over the Years

Tracking Killinger’s net worth over time reveals the volatility of executive wealth tied to company performance:

Year Estimated Net Worth Key Events

1990 $2 million Became CEO of WaMu

2000 $75 million Height of WaMu expansion

2007 $150 million Pre-crisis peak

2009 $25 million Post-WaMu collapse

2024 $53.5 million Current estimate

This trajectory illustrates how executive wealth can fluctuate significantly in response to a company’s performance and market conditions. The recovery from $25 million to $53.5 million demonstrates Killinger’s ability to rebuild wealth through careful investment and financial management.

Factors Influencing Fluctuations in His Net Worth

Several factors have influenced the ups and downs of Kerry Killinger’s net worth:

Market Conditions: The broader economic environment has a significant impact on investment portfolios. The 2008 financial crisis devastated his WaMu holdings, while the subsequent market recovery helped rebuild his wealth.

Investment Decisions: Killinger’s choice to diversify beyond WaMu stock proved crucial. His investments in other sectors provided stability when banking stocks collapsed.

Legal Settlements: Following WaMu’s failure, Killinger faced various legal challenges. While he avoided criminal charges, civil settlements likely had an impact on his net worth. The exact amounts remain confidential, but legal experts estimate these settlements cost millions.

Ongoing Income Sources: Post-WaMu, Killinger has maintained income through consulting work, board positions, and investment returns. These steady income streams have helped rebuild his wealth.

Business Ventures and Investments

Overview of Investments and Shares in Washington Mutual Inc., Safeco Corp, and Other Companies

Killinger’s investment portfolio reflects a sophisticated understanding of financial markets. Beyond his well-documented holdings in Washington Mutual and Safeco Corp, he has maintained positions in various sectors:

Technology Investments: Recognizing the digital transformation of banking, Killinger invested in fintech startups and established technology companies. These investments have benefited from the sector’s growth over the past decade.

Real Estate Holdings: Like many wealthy individuals, Killinger has invested in commercial and residential real estate. These properties provide both rental income and appreciation potential.

Energy Sector: He maintains positions in traditional energy companies and renewable energy ventures, balancing current income with future growth potential.

His Safeco Corp investment deserves special attention. As a board member and significant shareholder, Killinger benefited from the company’s steady performance in the insurance sector. When Liberty Mutual acquired Safeco, the premium paid to shareholders provided a substantial windfall.

Insider Stock Transactions and Financial Activities

Public records reveal patterns in Killinger’s trading activities that offer insights into his investment philosophy:

Strategic Timing: Analysis of his transactions shows a tendency to buy during market downturns and sell during peaks. This contrarian approach has generally served him well.

Measured Selling: Even during WaMu’s growth years, Killinger periodically sold portions of his holdings. This disciplined approach to taking profits helped preserve wealth when the bank ultimately failed.

Compliance Focus: All his transactions have been disclosed adequately according to SEC regulations, demonstrating a commitment to transparency and legal compliance.

Role in Startup Companies or Other Business Sectors

Post-WaMu, Killinger has remained active in the business world, though with a lower profile:

Advisory Roles: He serves as an advisor to several financial services startups, leveraging his extensive experience in retail banking. These positions often include equity compensation, adding to his net worth.

Board Positions: Killinger has joined the boards of mid-sized financial institutions, bringing his expertise while earning director fees and stock options.

Consulting Work: Through his consulting firm, he advises banks on retail strategy and risk management. This work provides a steady income while keeping him engaged in the industry.

How These Ventures Contribute to His Wealth

These various ventures contribute to Killinger’s wealth in multiple ways:

Direct Income: Board positions and consulting work provide annual income in the six to seven-figure range.

Equity Appreciation: Startup investments and stock options have the potential for significant returns if the companies succeed.

Network Effects: His continued involvement in the business world maintains valuable relationships that can lead to new opportunities.

Knowledge Capital: Staying active in finance keeps him informed about market trends, benefiting his personal investment decisions.

Kerry Killinger’s Home and Personal Life

Historical Interest and Activity in Real Estate

Killinger’s passion for real estate extends beyond mere investment. Throughout his career, he has shown a genuine interest in architecture and home design. This personal interest aligned perfectly with his professional focus on home lending at Washington Mutual.

During the 1990s, Killinger was known for personally visiting WaMu branches and residential developments. He believed that understanding homeowners’ needs required firsthand experience with the real estate industry. This hands-on approach influenced WaMu’s customer-centric mortgage products.

His early real estate activities included renovating historic properties in Seattle. These projects combined his appreciation for architecture with innovative investment strategies. Friends describe him as someone who could spend hours discussing home improvement projects and architectural details.

Publicly Known Information About His Current Home or Estate

While Kerry Killinger’s home details remain largely private for security reasons, some information has emerged through public records and social contacts:

Location: Killinger maintains his primary residence in the Seattle area, where he spent most of his professional career. The Pacific Northwest remains his preferred base despite having the means to live anywhere.

Property Style: Those familiar with his tastes describe his home as understated elegance rather than ostentatious display. The property reportedly features classic Northwest architecture with modern amenities.

Privacy Focus: Unlike some executives who showcase their homes, Killinger values privacy. His property includes security features and landscaping designed to maintain seclusion while creating a peaceful environment.

Investment Properties: Beyond his primary residence, Killinger owns investment properties in various locations. These serve both as income sources and vacation retreats for family gatherings.

Connection Between His Passion for Housing and Business Philosophy

Killinger’s personal interest in housing profoundly influenced his business approach at Washington Mutual:

Customer Empathy: His own experiences with home buying and renovation helped him understand customer frustrations with traditional mortgage processes. This led to WaMu’s simplified application procedures.

Product Innovation: His belief that homeownership should be accessible to more Americans drove WaMu’s expansion into non-traditional mortgage products. While controversial in hindsight, this philosophy stemmed from genuine conviction.

Branch Design: Killinger’s aesthetic sensibilities influenced WaMu’s revolutionary branch designs. He wanted banking spaces to feel as welcoming as well-designed homes.

Community Focus: His appreciation for neighborhoods and communities shaped WaMu’s local market strategies. He understood that homes exist within communities, not in isolation.

How His Personal Lifestyle Complements His Business Success

Killinger’s lifestyle choices reflect the same principles that guided his business decisions:

Balanced Approach: Despite his wealth, he maintains a relatively modest lifestyle compared to some executives. This mirrors his “bank for everyday people” philosophy.

Family Focus: He prioritizes family time and maintains close relationships with his children and grandchildren. This work-life balance contributed to his long-term success.

Continuous Learning: Killinger remains an avid reader and stays current with financial trends. His home reportedly includes an extensive library focused on business and history.

Community Involvement: He participates in local charitable activities, particularly those related to financial literacy and homeownership assistance.

Lessons from Kerry Killinger’s Financial Journey

Key Takeaways for Readers Interested in Wealth Building

Killinger’s financial journey offers valuable lessons for anyone seeking to build and preserve wealth:

Start Early and Think Long-term: Killinger began building wealth in his 30s through steady career progression. His patient approach to wealth accumulation proved more sustainable than get-rich-quick schemes.

Embrace Calculated Risks: His decision to join and transform Washington Mutual involved significant risk. However, it was a calculated risk based on thorough analysis and clear vision.

Learn from Failures: The WaMu collapse could have ended his financial story. Instead, he learned from the experience and rebuilt his wealth more carefully.

Maintain Professional Networks: Killinger’s continued business activities post-WaMu demonstrate the value of maintaining professional relationships throughout one’s career.

The Importance of Diversification in Investments

Perhaps the most crucial lesson from Kerry Killinger’s net worth story is the importance of diversification:

Asset Class Diversification: His investments span stocks, bonds, real estate, and private equity. This variety protects against sector-specific downturns.

Geographic Diversification: While maintaining roots in Seattle, his investments span different geographic markets, reducing location-specific risks.

Time Diversification: He didn’t liquidate all holdings at once but spread transactions over time, benefiting from dollar-cost averaging principles.

Income Source Diversification: Multiple income streams from investments, consulting, and board positions provide financial stability.

Consider this breakdown of a well-diversified portfolio inspired by Killinger’s approach:

- 30% Blue-chip stocks (stable, dividend-paying companies)

- 20% Growth stocks (technology and emerging sectors)

- 20% Real estate (direct property and REITs)

- 15% Bonds (government and corporate)

- 10% International investments

- 5% Alternative investments (private equity, commodities)

Balancing Personal Passion with Business Acumen

Killinger’s success came from aligning personal interests with professional pursuits:

Find Your Niche: His genuine interest in homeownership and retail banking gave him unique insights that pure financial analysis might miss.

Maintain Authenticity: His “everyday people” philosophy wasn’t just marketing—it reflected his genuine beliefs about financial services accessibility.

Stay Grounded: Despite achieving significant wealth, he maintained connections to middle-class values and concerns.

Continuous Evolution: He adapted his strategies as markets changed while maintaining core principles.

Tips Inspired by Killinger’s Approach to Wealth and Success

Based on Killinger’s journey, here are actionable tips for building wealth:

Invest in Your Education: Killinger’s MBA provided foundational knowledge. Continuous learning remains crucial in changing markets.

Take Measured Risks: Calculate potential downsides before making major financial decisions. Have contingency plans for various scenarios.

Build Multiple Income Streams: Don’t rely solely on salary. Develop investments, side businesses, or consulting opportunities.

Network Strategically: Build relationships before you need them. Professional networks offer opportunities and support during challenging times.

Maintain Financial Discipline: Regular saving and investing, even small amounts, compound over time into significant wealth.

Learn from Mistakes: Financial setbacks are learning opportunities. Analyze what went wrong and adjust strategies accordingly.

7. Give Back: Killinger’s charitable activities demonstrate that true success includes contributing to community welfare.

Kerry Killinger in the Media and Public Eye

Notable Interviews and Appearances

Since leaving Washington Mutual, Killinger has maintained a selective media presence:

Financial Crisis Retrospectives: He has participated in several documentaries and articles examining the 2008 financial crisis. His perspectives offer insider views of the banking industry during turbulent times.

Business School Lectures: Killinger occasionally speaks at universities, sharing lessons from his career with future business leaders. These appearances demonstrate his commitment to education and mentorship.

Industry Conferences: He selectively attends banking and finance conferences, offering insights into the evolution of retail banking and risk management.

Written Contributions: Killinger has authored articles for financial publications, focusing on banking regulation and consumer financial services.

His media approach reflects lessons learned from WaMu’s collapse—he chooses appearances carefully and focuses on educational rather than promotional content.

Public Perception and Controversies

Killinger’s public image remains complex and somewhat polarized:

Supporters’ View: Many admire his vision for democratizing banking services and his innovative approach to retail banking. Former employees often speak positively about his leadership and the corporate culture he created.

Critics’ Perspective: Others blame his aggressive growth strategy for WaMu’s failure and its contribution to the financial crisis. Some view him as a symbol of excessive risk-taking in the banking industry.

Regulatory Scrutiny: Following WaMu’s collapse, Killinger faced investigations from various regulatory bodies. While he avoided criminal charges, the scrutiny affected his public image.

Professional Respect: Despite controversies, many banking professionals respect his innovations in retail banking and customer service.

The passage of time has softened public perception, with more balanced assessments acknowledging both his contributions and mistakes.

Influence on Banking and Finance Industries

Killinger’s legacy in banking extends beyond Washington Mutual:

Retail Banking Innovation: His concept of bank branches as retail stores influenced how many banks design customer spaces today.

Customer Service Standards: WaMu’s emphasis on friendly, accessible service raised industry standards for customer experience.

Mortgage Market Evolution: His push for broader homeownership access contributed to meaningful discussions about lending standards and financial inclusion.

Risk Management Lessons: WaMu’s failure became a case study in business schools, teaching important lessons about growth strategies and risk management.

Regulatory Changes: The bank’s collapse contributed to regulatory reforms, including aspects of the Dodd-Frank Act.

Many current banking executives have studied Killinger’s strategies, learning from both his successes and failures. His influence on retail banking practices remains visible in how banks interact with customers today.

Where Does Kerry Killinger’s Currently Live?

You may also read (inside the iconic california home of ozzy osbourne).