Hey there, homeowner or aspiring buyer—let’s talk about something that hits close to home: taxes. Owning a home is exciting. You get to pick out that perfect paint color, landscape the yard, or even dive into some fun home decor projects. But along with the joys come the bills, and homeownership taxes can feel like a maze. One question that frequently arises is, are real estate taxes the same as property taxes? It’s a common mix-up, and trust me, you’re not alone if you’ve scratched your head over it.

Picture this: You’ve just closed on your dream house, and now you’re staring at your first home tax bill. Is that line item for “real estate taxes” or “property taxes”? Are they interchangeable, or is there a sneaky difference that could affect your wallet?

Why does this matter? Well, understanding that real estate taxes are the same as property taxes can save you from surprises during tax season. It helps with budgeting for things like mortgage payments, home improvements, or even those decor upgrades you’re eyeing. For instance, if you’re a real estate agent like some folks I know, explaining this to clients can build trust and make you the go-to expert. Sites like homeimprovementcast.co.uk often touch on how taxes tie into home value—think about how a well-decorated space might boost your property’s assessed worth.

What Are Real Estate Taxes?

Defining Real Estate Taxes Simply

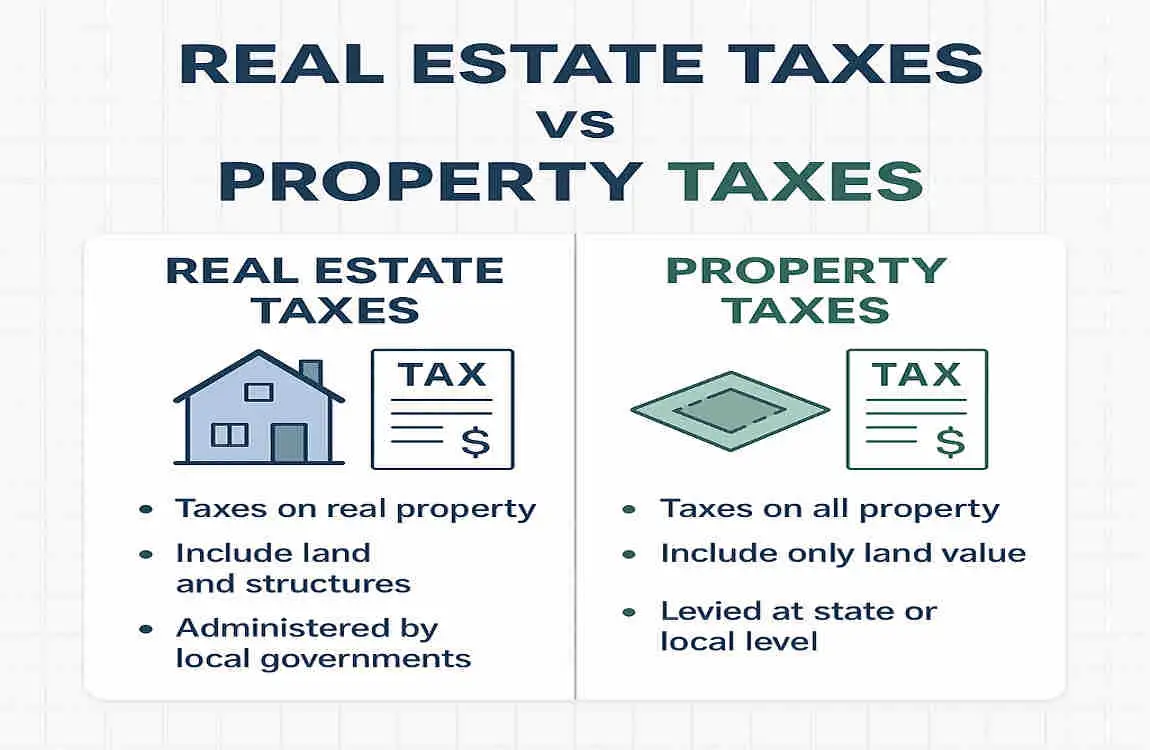

Okay, let’s start with the basics. Real estate taxes are basically fees that homeowners pay based on the value of their land and any buildings on it. Think of them as a way local governments collect money to keep your community running smoothly. If you’ve ever wondered why your neighborhood has great schools or well-maintained parks, these taxes are often the unsung heroes behind it.

In simple terms, real estate taxes target “real property”—that’s everyday language for land, homes, and structures that aren’t movable. Unlike personal items like your car or furniture, real estate is fixed in place. So, when you own a house, you’re on the hook for these taxes annually or sometimes biannually.

How They’re Assessed and Calculated

Now, how do they figure out what you owe? It all boils down to a property tax assessment. Local assessors look at your home’s market value—what it could sell for today. They might visit your property, check recent sales in the area, or even consider improvements you’ve made, like adding a fancy kitchen remodel.

Calculation is straightforward: They take your home’s assessed value, multiply it by the local tax rate (often called a millage rate), and boom—there’s your bill. For example, if your home is valued at $300,000 and the rate is 1%, you’d owe $3,000. But don’t worry, it’s not always that cut-and-dry; deductions or exemptions can lower it.

Who Levies These Taxes?

Local governments are the ones calling the shots here. That could be your city, county, or township. They set the rules and send out the bills. In some places, like bustling urban areas, multiple entities might dip into the pot—think school districts or fire departments.

Imagine you’re in a place like California, where real estate taxes help fund everything from public transit to libraries. Or in a rural spot in Texas, where they might focus more on road maintenance. No matter where, these taxes keep things local and relevant to your daily life.

What Do They Fund?

Real estate taxes aren’t just random charges—they have a purpose. They typically pay for essential services, such as education, police and fire protection, and infrastructure, including bridges and sewers. Without them, your community wouldn’t thrive.

Take schools, for instance. A big chunk often goes toward teachers’ salaries and classroom supplies. Public services? That’s your garbage pickup and street cleaning. And infrastructure? Roads, parks, and even those community centers where you might host a home decor workshop.

Examples in Action

Let’s make this real. Suppose you live in New York City. Your real estate tax payment might be higher due to dense population and high property values, funding things like subway repairs. Contrast that with a suburban home in Florida, where taxes could be lower but still cover hurricane preparedness.

If you’re into home decor, as some real estate pros are, remember that upgrades like a new deck could bump up your assessed value—and thus your taxes. Check out resources like homeimprovementcast.co.uk for tips on value-adding decor that won’t break the bank on taxes. All in all, understanding that real estate taxes are the same as property taxes starts with grasping these as key players in homeownership.

What Are Property Taxes?

A Clear Definition of Property Taxes

Shifting gears, let’s talk property taxes. These are charges levied on the value of your property, which includes land, buildings, and sometimes even attached items like sheds or pools. In everyday speak, it’s the government’s way of saying, “Hey, you own this stuff—help us fund the community.”

You may also read (navigating phuket srental scene as a tourist).

Property taxes are broad; they cover anything considered “property” under local laws. For homeowners, this means your house and the land it’s on. It’s not just about the structure—it’s the whole package.

The Scope: Land, Buildings, and More

Property taxes cast a wide net. They assess land value separately from improvements (like your home or garage). Why? Because bare land has value, but adding a building significantly boosts it.

In some areas, they even include personal property if it’s tied to the real estate, like built-in appliances. Imagine your cozy home office setup— if it’s permanent, it might factor in.

Regional Differences in Terminology

Here’s where it gets interesting: Terminology varies by region. In the U.S., “property taxes” is the go-to term in most states, but places like the Northeast might lean toward “real estate taxes.” Internationally, in the UK or Canada, you might hear “council tax” or “municipal tax” instead.

For example, in Texas, property taxes are straightforward and heavily fund local schools. Head to Illinois, and assessments might feel more complex due to varying county rules. These differences can confuse folks moving cross-country.

Funding and Assessment Methods

Like real estate taxes, property taxes fund local goodies: schools, roads, and emergency services. Assessments happen periodically—maybe every few years—using market data, appraisals, or even drone footage in modern setups.

Your bill arrives via mail or online, and payment is key to avoiding liens. Miss it? Penalties add up fast.

Real-World Examples

Consider a family in Colorado: Their property tax assessment might include mountain views boosting land value, funding ski town infrastructure. Or in Florida, where hurricane-resistant homes could qualify for breaks.

If you’re budgeting for home decor, higher property taxes mean tightening the belt on that new living room set. As a real estate agent, explaining this to clients can highlight why location matters—wondering if real estate taxes are the same as property taxes? We’re getting there—hang tight.

Key Similarities Between Real Estate Taxes and Property Taxes

Overlapping Aspects in Ownership

Both real estate taxes and property taxes revolve around owning real property—that’s land and structures. They target homeowners, ensuring you contribute based on what you own.

This overlap means they’re often used interchangeably in casual chats. If someone asks, Are real estate taxes the same as property taxes, the answer is frequently “pretty much” in practice.

Similar Assessment and Billing Processes

Assessment? Identical in many ways. Both use your home’s value, local rates, and exemptions. Billing comes from the same local offices, often lumped into your mortgage escrow.

You pay them similarly, too—annually, quarterly, or via escrow for ease.

Financial Impact on Homeowners

These taxes hit your wallet alike. They increase homeownership taxes overall, affecting affordability. A rising assessment means higher bills, squeezing your budget for things like decor or repairs.

Both can lead to tax deductions for homeowners on federal returns, like mortgage interest tied to them.

Shared Role in Funding Communities

They fund the same stuff: schools, safety, infrastructure. Your payment supports your neighborhood directly.

Imagine both taxes pooling to build a new playground—it’s collaborative community building.

In short, while nuances exist, these similarities make them feel like twins. But as we’ll see, differences matter too.

Key Differences Between Real Estate Taxes and Property Taxes

Interchangeable Terms or Not?

Let’s cut to the chase: In many places, people use “real estate taxes” and “property taxes” as synonyms. But dig deeper, and contexts vary. For instance, “real estate taxes” might specifically mean taxes on immovable property, while “property taxes” could include personal items in some states.

If you’re pondering whether real estate taxes are the same as property taxes, know it’s often a yes—but not always. Regional lingo plays a significant role.

Legal and Technical Nuances by Location

Legally, differences pop up. In states like New York, “real estate taxes” are ordinary for residential levies, emphasizing land. Property taxes may also also pass commercial or industrial properties

Internationally, the UK separates “stamp duty” (a real estate tax on purchases) from ongoing property taxes. In the U.S., federal vs. state rules add layers—think homestead exemptions in Florida that apply to property taxes but are not always labeled as real estate ones.

Variations in Tax Bases and Methods

Tax bases differ subtly. Real estate taxes might focus narrowly on land value, excluding personal property. Property taxes? They could include vehicles or equipment if your home has a business element.

Assessment methods vary, too. Some areas use fair market value for real estate taxes, while property taxes might rely on replacement cost. Regulations like Proposition 13 in California cap increases for property taxes, but real estate phrasing might not highlight that.

Broader or Narrower Usage

Sometimes “real estate taxes” refers broadly to all realty-related fees, including transfer taxes. Property taxes stick to annual ownership dues.

This can confuse buyers. Say you’re in Massachusetts—real estate taxes might imply municipal levies, while property taxes cover county add-ons.

Case Studies and Examples

Take Case Study 1: A homeowner in Pennsylvania contests a property tax assessment that’s skyrocketed due to a home addition. They learn that “real estate taxes” in local jargon excludes that addition temporarily, saving money.

Case Study 2: In Oregon, a family discovers their “property taxes” include forest land exemptions, but “real estate taxes” terminology in appeals focuses on urban vs. rural rates.

Another example: During a market boom in Texas, property values soar, hiking taxes. But if labeled as real estate taxes, certain abatements for eco-friendly homes apply differently.

Reader, have you checked your own bill? These distinctions could mean appealing for relief.

To avoid keyword stuffing, remember: Understanding whether real estate taxes are the same as property taxes hinges on your location. Consult local pros for clarity.

How Real Estate Taxes and Property Taxes Impact Your Homeownership Costs

Ties to Mortgage Payments and Escrow

Both taxes sneak into your monthly mortgage via escrow accounts. Lenders collect a portion each month to cover your annual real estate tax payment or property tax bill. It’s convenient, but it can increase your payment.

If assessments rise, so does your escrow—meaning tighter budgets.

Budgeting and Financial Planning Implications

These taxes force thoughtful planning. Factor them into your home-buying budget; a $2,000 annual bill adds $167 monthly.

For decor lovers, high taxes might delay that kitchen reno. As a real estate agent, you know this—clients often overlook it.

Potential Tax Deductions

Good news: Tax deductions for homeowners apply. Deduct property taxes on your federal return (up to $10,000 for married couples). Real estate taxes qualify, too.

This softens the blow, especially if you’re itemizing.

Tips for Managing Tax Bills

Track assessments annually. Use online tools for estimates.

Budget by setting aside funds monthly. Appeal if values seem off—many win reductions.

If you’re into home improvements, sites like homeimprovementcast.co.uk offer advice on tax-smart upgrades. Wondering if real estate taxes are the same as property taxes? Both impact costs similarly, so stay vigilant.

Common Misconceptions About Real Estate and Property Taxes

Myth 1: They’re Completely Different Things

Many think real estate taxes and property taxes are worlds apart. Not true—they overlap hugely. Debunked: They’re often the same, just different labels.

You Can’t Fight Them

Wrong! Appeals work. If your assessment feels high, challenge it with evidence like comparable sales.

They Only Fund Schools

They do, but also roads, safety, and more. Clarify by reviewing your bill’s breakdown.

Practical Advice

Verify statements online or at tax offices. Understand terms to avoid overpaying.

For accurate payments, consult pros. This ties back to knowing that real estate taxes are the same as property taxes—busting myths.

Here’s a quick list of common myths to watch out for:

- Myth: Taxes are fixed forever. Reality: They change with assessments.

- Myth: Renters dodge them. Reality: Landlords pass costs on.

And a table for easy reference:

Misconception: Truth Tip for Homeowners

Taxes are constantly increasing. They can decrease with appeals or exemptions. Check annual assessments regularly.

Only homeowners pay. Businesses and landlords do too. Factor this into rental budgets.

No deductions available, up to $10,000 federal cap. Itemize on your tax return

How to Verify Your Real Estate or Property Tax Information

Finding Your Assessment Online

Start simple: Visit your county’s website. Search for “tax assessor” and input your address. You’ll see your property tax assessment details.

Many sites offer portals for easy access.

Steps to Contest or Appeal

Disagree? Gather proof—photos, comps. File an appeal form by the deadline.

Attend hearings if needed; present calmly.

Resources and Tips

Use IRS.gov for federal info, or state sites for local rules.

Communicate via email or phone with authorities—be polite.

For more, if you’re into real estate, check homeimprovementcast.co.uk. Remember, verifying answers are real estate taxes, the same as property taxes locally.

You may also read (thailands government is considering changing foreign condo ownership rates and holding terms here is what you need to know to be ready to move in).