Hey there! Are you a homeowner or thinking about buying a house? If so, you’ve probably heard about house taxes and how they can impact your finances. But here’s the thing: understanding the different types of taxes related to real estate can be confusing. That’s why we’re here to help!

Is real estate tax the same as property tax? We’ll break down the definitions, explore how these taxes are calculated, and discuss their impact on homeowners and buyers. By the end, you’ll have a clear understanding of what these taxes mean for you and your property.

What is Real Estate Tax?

Definition of Real Estate Tax

Real estate tax is a tax imposed on the ownership of real property, such as land and buildings. It’s a way for local and state governments to generate revenue to fund public services and infrastructure.

Who Levies Real Estate Tax?

Local governments, such as counties or municipalities, typically levy real estate taxes. In some cases, state governments may also impose real estate taxes.

Calculation Methods

The calculation of real estate tax is usually based on the assessed value of the property. This value is determined by a local assessor who considers factors like the property’s size, location, and condition. The estimated value is then multiplied by the local tax rate to determine the amount of real estate tax owed.

Purpose of Real Estate Tax Revenue

The revenue generated from real estate taxes is often used to fund essential community services. This can include services such as public schools, road maintenance, and emergency services. By paying real estate taxes, homeowners are contributing to the well-being of their local area.

Examples of Real Estate Tax Application

Let’s say you own a home valued at $200,000 in a county with a real estate tax rate of 1%. Your real estate tax bill would be $2,000 per year ($200,000 x 0.01). However, keep in mind that real estate tax rates and assessment methods can vary from one location to another.

Variations by State or Country

It’s worth noting that real estate tax laws and regulations can differ significantly between states and countries. Some areas may have higher or lower tax rates, while others may offer exemptions or deductions for certain types of properties or owners.

What is Property Tax?

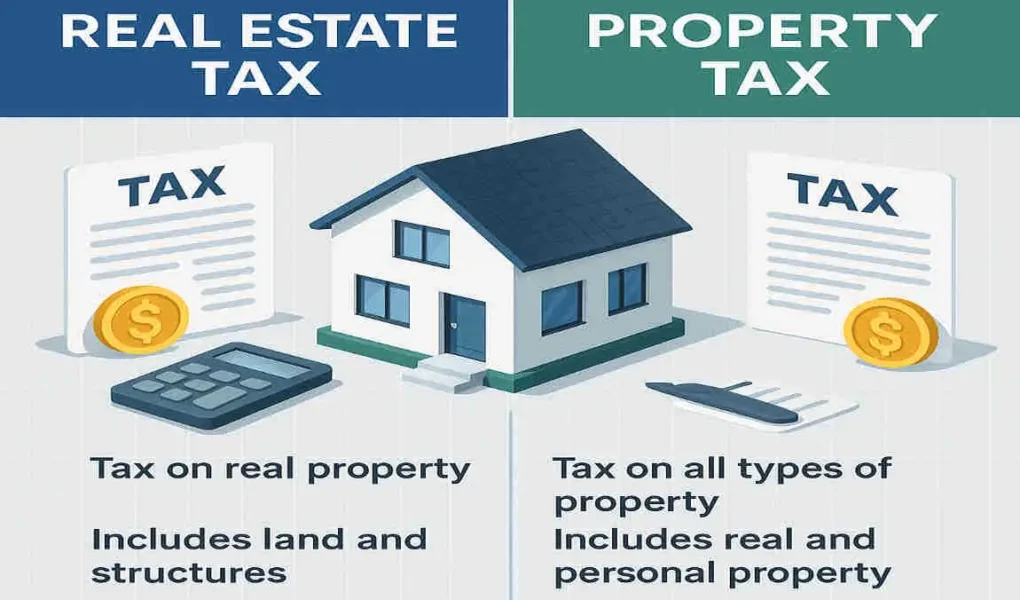

Definition and Distinction from Real Estate Tax

Property tax is a tax levied on the ownership of various types of property, including real estate, personal property, and sometimes even intangible assets. While real estate tax is a specific type of property tax that focuses on land and buildings, the term “property tax” can be broader in scope.

You may also read (navigating home or property disputes what you need to know).

Types of Properties Subject to Property Tax

Property tax can apply to a wide range of assets, such as:

- Homes and residential properties

- Land and undeveloped lots

- Commercial and industrial buildings

- Vehicles and personal property

Taxable Value vs. Market Value

When it comes to property tax, it’s essential to understand the difference between taxable value and market value. Taxable value is the amount used to calculate the property tax, while market value is the estimated price the property would fetch on the open market. In many cases, the taxable value is lower than the market value.

Determination and Assessment of Property Tax Rates

Local governments typically set property tax rates and can vary based on factors like the type of property, its location, and the community’s financial needs. The assessed value of the property is multiplied by the applicable tax rate to determine the amount of property tax owed.

Common Uses for Property Tax Funds

Just like real estate tax revenue, property tax funds are often used to support essential services and infrastructure within the community. This can include initiatives such as public education, road maintenance, and emergency services.

Variations in Property Tax Rules

Property tax laws and regulations can vary significantly from one jurisdiction to another. Some areas may have different assessment methods, tax rates, or exemptions and deductions available to property owners. It’s essential to understand the specific rules that apply to your property.

Detailed Comparison: Real Estate Tax vs Property Tax

Is Real Estate Tax the Same as Property Tax?

Now, let’s address the big question: Is real estate tax the same as property tax? The answer is both yes and no, depending on the context and location.

Similarities Between Real Estate Tax and Property Tax

In many ways, real estate tax and property tax are similar. Both are taxes based on the ownership of property, and both are typically assessed and collected by local governments. The amount of tax owed is often determined by multiplying the estimated value of the property by the applicable tax rate.

Potential Differences in Definition and Usage

However, there can be differences in how the terms “real estate tax” and “property tax” are defined and used in different regions or contexts. In some areas, the terms may be used interchangeably, while in others, “property tax” may refer to a broader range of taxes that include real estate tax but also encompass other types of property.

Clarifying Misconceptions and Common Confusions

One common misconception is that the terms ‘real estate tax’ and ‘property tax’ are interchangeable. While this may be true in some jurisdictions, it’s not a universal rule. It’s essential to understand the specific definitions and applications of these taxes in your area to avoid confusion.

Examples and Case Studies

To illustrate the similarities and differences between real estate tax and property tax, let’s consider a few examples:

- In State A, the term “property tax” is used to refer to all taxes on property ownership, including real estate tax. Here, real estate tax is a subset of property tax.

- In State B, “real estate tax” and “property tax” are used interchangeably to refer to the same tax on land and buildings.

- In Country C, “property tax” includes taxes on both real estate and personal property, while “real estate tax” refers explicitly to taxes on land and buildings.

Impact on Homeowners and Real Estate Investors

Understanding the nuances of real estate tax and property tax is crucial for homeowners and real estate investors. These taxes can significantly impact the overall cost of owning and maintaining a property, and they may vary depending on the type of property and its location.

How House Taxes are Calculated

Determining Assessed Value

The first step in calculating house taxes is determining the assessed value of the property. This is typically done by a local assessor who considers factors like the property’s size, location, and condition. The estimated value may be lower than the market value of the property.

Role of Appraisal and Market Value

Appraisals can play a role in determining the assessed value of a property. An appraiser will evaluate the property and provide an estimate of its market value, which may influence the assessed value used for tax purposes.

Tax Rates and Millage

Once the assessed value is determined, it’s multiplied by the applicable tax rate to calculate the amount of house tax owed. Tax rates are often expressed in terms of millage, which represents the number of dollars of tax per $1,000 of assessed value.

Exemptions, Abatements, and Deductions

In some cases, property owners may be eligible for exemptions, abatements, or deductions that can reduce their house tax liability. These can include things like homestead exemptions for primary residences or tax breaks for seniors or veterans.

Common Types of Tax Assessments

There are several common types of tax assessments related to real estate ownership, including:

- Ad valorem assessments, which are based on the assessed value of the property

- Special assessments, which are levied for specific purposes like funding public improvements

- Supplemental assessments, which may be applied when a property undergoes significant changes or improvements

You may also read (are real estate taxes and property taxes the same for your home).